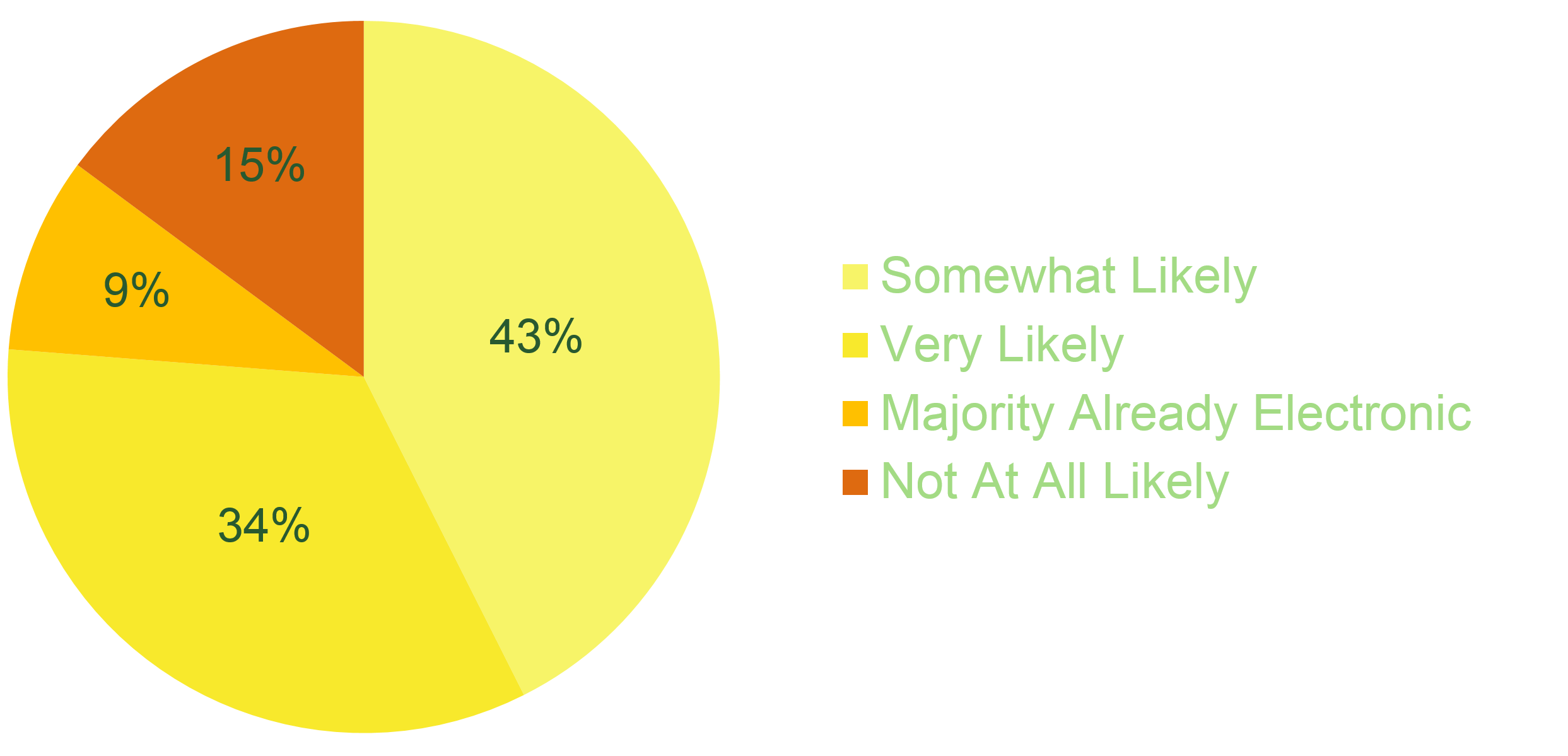

As more and more companies are experiencing the transition from check payments and attached remittances to electronic payments and disassociated remittances sources, it has created a serious cash application challenges for these companies. In the most recent Federal Reserve Payments Study, 85% of check payments are being replaced by electronic payments. As the number of electronic payments continues to rise, so will the issues associated with processing these electronic remittances, leading to more difficult cash application.

Remittance Matching Issues

With lockbox systems or mail delivery, businesses received envelopes with the check and remittance information. While processing this information is more labor intensive, everything is in one envelope, helping accounting teams apply the payment correctly. If a business submits one check to pay for multiple invoices, staff can use the enclosed remittance slip to divide the payment appropriately.

When payment comes in electronic form, either ACH, wire, or card, the remittance arrives separately, by email, mail, web portal, or some other means. Having to match the payments and remittances coming from multiple sources is difficult. If one payment is issued for multiple invoices, cash application gets even more confusing.

Cash Flow and Staffing

Another challenge all businesses face is managing resources. Businesses may find that multiple payments come in at the same time each month, often mid or month end, making it difficult for their limited staff to manage these peaks efficiently. During these times, teams are required to work overtime, leading to burnout and higher costs. Businesses often lack the in-house expertise or resources to solve their remittance challenges.

The Solution

No matter what level of expertise a business’s leadership team has, a good first step is to go through a requirements and definitions study, to determine the issues and current processes. When looking for a solution, you have the option of either resolving the issues in-house or looking for a third party service provider. Unless you have the in-house resources necessary to implement a solution, a Software as a Service (SaaS) provider may be the best option, because it provides a rapid implementation without a capital investment.

An automated cash application solution can match payment, remittance, and invoice information in one system. This will eliminate most of the work, avoiding errors, freeing up resources, and reducing costs. With the right technology in place, businesses can resolve any challenges they face in their time-sensitive cash application process.

Data in graphs Source: Federal Reserve System. 2013 Federal Reserve Payments Study. July 2014. Print.

2 Responses

Thanks, this was quite informative

Hi , I do believe this is an excellent blog.

I stumbled upon it on Yahoo , I ‘ll come back once again.